Is £35k a good salary in the UK?

35k is around the average salary in the UK, and will be enough to live in most parts of the country - though in London it will be trickier.

Key takeaways

- The average UK salary is £35,464

- £35,000 is roughly £2,200 per month in take home pay.

- Roughly 40-50% of people in the UK earn more than £35,000 annually.

Table of contents:

- Is 35k a good salary?

- Breaking down 35k after tax

- How much rent could I afford on 35k?

- What mortgage could I get on 35k?

- What jobs pay 35k or more?

- Frequently asked questions

Is 35k a good salary in the UK?

35k is a solid UK salary, and is in fact slap bang in the middle of average salaries for the UK. With £35,000 you'd be able to live in many parts of the country, although renting in cities - particularly in the South, and even more so in London - could make things a bit tight.

Up North or in the Midlands, £35,000 will go further thanks to the lower cost of living, and the much lower costs of rentals and mortgages.

Though the average salary in the UK sits at roughly £35,000 as of 2023, it's likely to rise in 2024 due to the high levels of inflation the country has experienced.

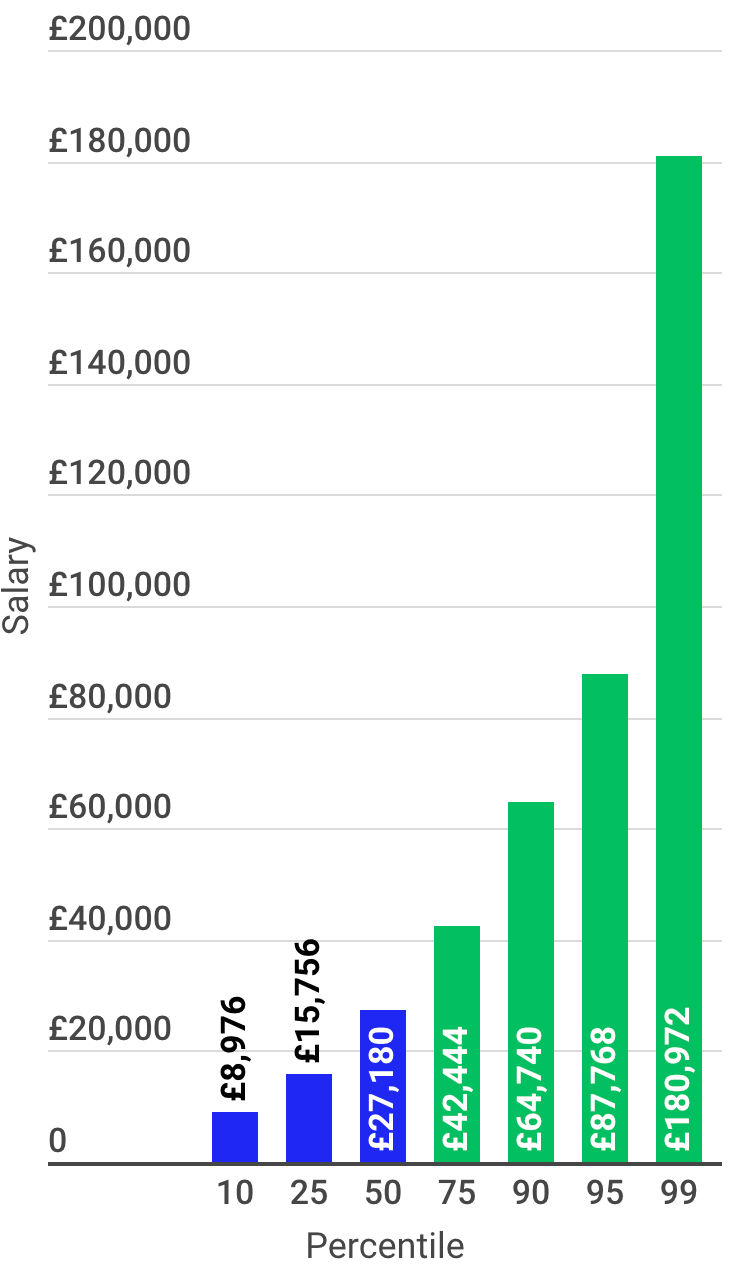

Here’s a visual breakdown of where £35,000 sits in relation to other salaries:

While £35,000 puts you in the top half of earners in the UK, you'd need to be earning around £42,000+ to be in the top 25% - which we've coloured in green.

Breaking down 35 after tax

In the table below you can see the a rough estimate of what £35,000 might look like after tax, using an online salary calculator tool. As you can see, your monthly take home pay is around £2,213

| Year | Month | Week | |

| Gross Wage | £35,464 | £2,955 | £682 |

| National Insurance | £2,633 | £229 | £53 |

| Pension | £1,064 | £89 | £20 |

| Pension HMRC | £213 | £18 | £4 |

| Student Loan | £735 | £61 | £14 |

| Take Home Pay | £26,666 | £2,213 | £511 |

| Tax Free Allowance | £12,570 | £1,048 | £242 |

| Tax Paid | £4,366 | £364 | £84 |

| Taxable Wage | £21,830 | £1,819 | £420 |

Calculating how much £35,000 comes to after tax can vary based on individual circumstances. You’ll need to factor in the following:

- Income tax.

- National Insurance contributions

- Pension contributions.

- Student loans.

- Other deductions.

How much rent could I afford on £35,000?

With a £35,000 salary you’d be able to afford a two bedroom flat in most ares of the UK cities. Depending on the region, you could afford more or less.

Take a look at the table below, which shows the average rents across regions of UK to get an idea of what you can afford. It’s safe to assume rents outside of cities will be cheaper.

| Region | Average | Lower quartile | Median | Upper quartile |

| England | £899 | £625 | £800 | £1,050 |

| North East | £543 | £450 | £500 | £600 |

| North West | £682 | £525 | £630 | £775 |

| Yorkshire and the Humber | £674 | £525 | £632 | £795 |

| East Midlands | £668 | £575 | £650 | £750 |

| West Midlands | £715 | £600 | £695 | £800 |

| East | £946 | £760 | £900 | £1,100 |

| London | £1,727 | £1,313 | £1,500 | £1,857 |

| South East | £1,049 | £875 | £1,000 | £1,200 |

| South West | £859 | £700 | £800 | £950 |

Based on this, and considering that you'd have take home pay of roughly £2,200, you could afford to rent a 2 bedroom place anywhere in the country, although in the South it'll be harder - and in London even more so.

In London you'd have to look at sharing a house to reduce costs, or sacrifice a very large chunk of your salary on rent - which would leave you with very little left over if you chose to do that.

What mortgage can I get for £35,000?

While some lenders will offer more than others, as a rule of thumb, most applicants can borrow up to 4 or 4.5 times their annual income based on mortgage affordability rules.

So, if you're on £35,000 that means you can borrow somewhere in the region of £140,000 to £157,500.

Plugging £157,000 into a mortgage calculator, and assuming a 4.5% interest rate, that's around £795.50 a month in mortgage payments.

To get a more detailed breakdown it’s worth visiting mortgage providers directly and entering your specific information into their mortgage calculators.

What jobs pay £35,000 or more?

Lots of jobs pay more than £35,000 in the UK. Since this is around the average UK salary, by definition almost half of the jobs in the UK pay more than £35k.

Here is a somewhat random list of jobs which pay in the region of £35k, to give you some ideas:

- Skilled Trades:

- Electrician (£32,000 - £42,000)

- Plumber (£28,000 - £40,000)

- Carpenter (£25,000 - £35,000)

- Transportation and Logistics:

- Train Driver (£32,000 - £50,000)

- Air Traffic Controller (£35,000 - £60,000)

- Logistics Manager (£30,000 - £45,000)

- Manufacturing:

- Production Manager (£30,000 - £45,000)

- Quality Assurance Inspector (£25,000 - £35,000)

- CNC Machinist (£25,000 - £35,000)

- Healthcare Support:

- Paramedic (£25,000 - £35,000)

- Occupational Therapy Assistant (£20,000 - £30,000)

- Medical Laboratory Technician (£20,000 - £30,000)

- Hospitality and Catering:

- Hotel Manager (£25,000 - £40,000)

- Restaurant Manager (£25,000 - £40,000)

- Chef de Partie (£20,000 - £30,000)

- Retail Management:

- Store Manager (£25,000 - £40,000)

- Retail Buyer (£30,000 - £40,000)

- Merchandiser (£25,000 - £35,000)

- Customer Service:

- Customer Service Manager (£25,000 - £40,000)

- Call Center Team Leader (£22,000 - £35,000)

- Client Relationship Manager (£25,000 - £35,000)

Frequently asked questions

- Is £35,000 considered middle class?

- £35,000 is often seen as middle class, but its status depends on where you live and your lifestyle choices.

- Is £35,000 enough to live on in London?

- £35,000 in London can be tight due to high living costs, but with budgeting and modest living choices, it's feasible for some to manage.

- What percentage of people earn more than £50,000 in the UK?

- Roughly 40-50% of people in the UK earn more than £35,000 annually, placing it around the middle income range.